Money Mates

Because finances can be fun.

Money Mates

Who we are.

Money Mates believes that financial literacy is a cornerstone of personal and professional success. Our mission is to make finance engaging, accessible, and enjoyable for students and learners of all backgrounds.

By combining advanced AI technology with curated lessons, we offer tailored educational experiences that empower individuals to confidently navigate their financial journeys. Through innovative teaching methods and interactive learning, we strive to transform complex financial concepts into relatable and practical knowledge.

A message from our founders

Are you excited about graduation? Can’t wait to enter the real world - but then slowly realize you know nothing about finances? Enter Money Mates, your new best friend in navigating the murky waters of financial literacy.

Created with the understanding that learning about finances can feel like pulling teeth, Money Mates is like that cool, patient friend who breaks things down into bite-sized, engaging lessons.

No more boring lectures or complicated jargon. Just personalized, fun content tailored to your interests and learning style, so you can finally feel confident about managing your money.

Let's face it, adulting is hard enough – let Money Mates make the finance part a little less painful.

Betsy Porter

Maya Gómez Gallagher

Eliza Hodges

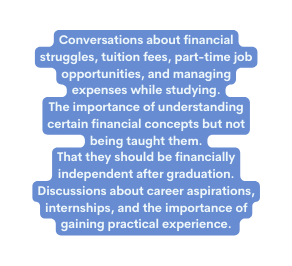

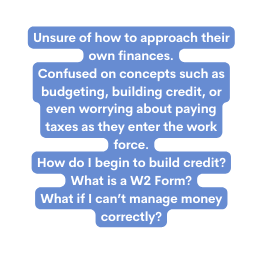

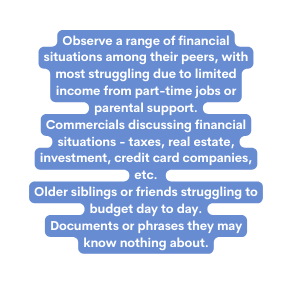

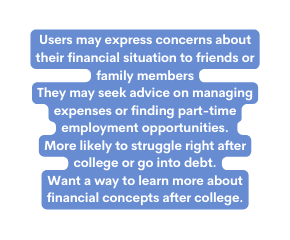

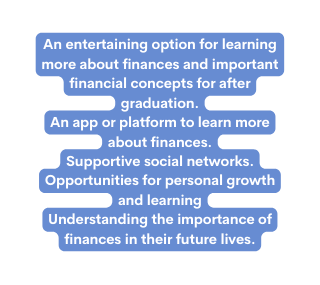

Empathy Map

Students aged 17-23

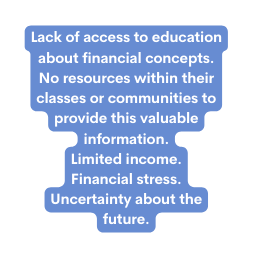

SURVEY #1 RESULTS

Our User Survey: presents a snapshot of financial awareness and preparedness among a group of 28 respondents.

Demographic

Questions

Knowledge

Questions

Personal Experience

Questions

Research

Questions

General Attitudes

- When asked about personal finance knowledge for post-graduate life, respondents showed a spread across the scale, indicating varying levels of expertise. Most rated themselves in the mid-range (2 and 3 on a scale of 5), suggesting moderate knowledge.

- Confidence in managing personal finances was also varied, with the largest group (35.7%) choosing a mid-range confidence level (3 on a scale of 5).

- Over half of the respondents have created a budget for themselves (53.6%) or a savings plan/set financial goals (53.6%).

- A significant majority (67.9%) have not had any formal education related to personal finance in college or high school. However, those who did mention specific courses or engagement with the subject.

- The majority of respondents rely on websites (60.7%) as their primary resource for learning about personal finance, with some also using books, courses, or learning from parents.

- All respondents (100%) unanimously agree that learning about personal finances would be beneficial.

User Profile:

https://www.moneymates.com/userprofile

Demographics:

17-23, male and female. Their income is on the lower side as most college and high school students do not have full time 5-6 figure jobs. The education level would be high school and college students.

Psychographics:

Due to our Users financial situation our uses may lead a budget-conscious lifestyle, balancing academic commitments with part-time work and social activities. Most likely our users do not know much about financials once they are on their own/post graduation from high school or college.

Unmet Need:

Lack of knowledge around various financial concepts for life post-graduation.

Potential Solutions:

~ Creating an app for learning about various different financial topics.

~ Helps to teach about the purpose of a credit card, or when to do your taxes, or what a W2 form is, etc.

~ Lessons of fun videos featuring celebrities or influencers that are teaching our users about financial literacy. Think about the celebrity cameos in the movie The Big Short.

Features:

~ Website that has a blog about financial literacy and information about our App.

~ App with weekly, quick and entertaining lessons.

~ Offering incentives, such as certificates of completion, badges, or points that students can accumulate and redeem for rewards or privileges.

Key Benefits:

~ Allows for students to gain a greater understanding of how to manage finances and money in a post grad - independent world.

~ Can encourage students to become more financially independent earlier.

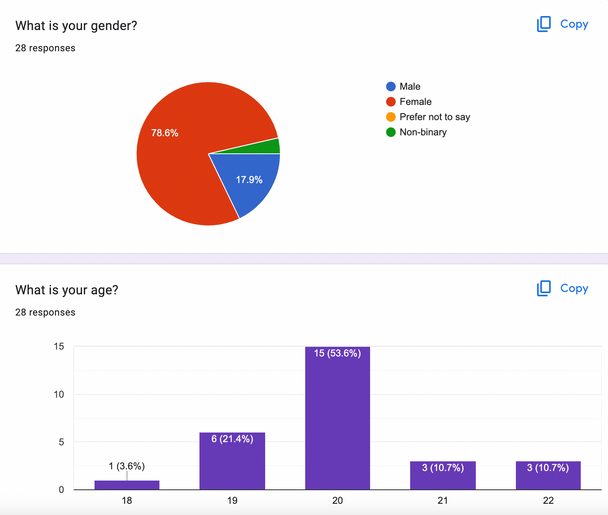

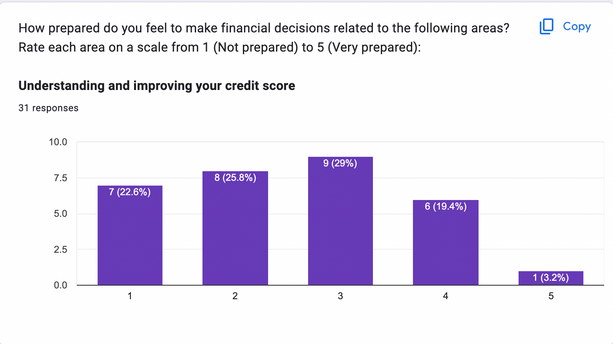

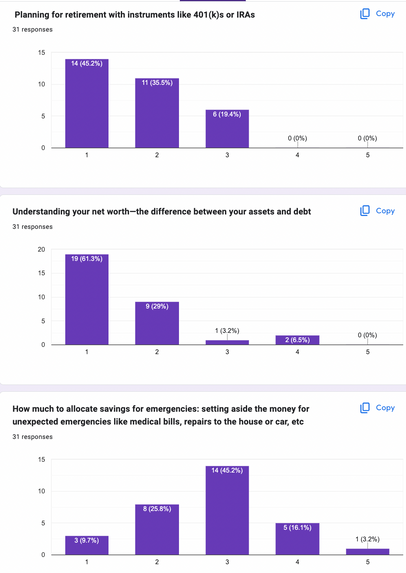

Follow-Up Survey

Our follow up survey further explores the specifics about financial knowledge and understanding among a group of 31 respondents.

Demographic

Questions

Personal Finance

Questions

Personal Finance

Questions

Personal Finance

Questions

Knowledge

Questions

How Might We...

... create a personalized, engaging, and accessible learning experience that demystifies financial concepts for young adults?

... leverage AI to tailor financial lessons to individual learning styles and needs?

... make financial concepts more relatable and understandable for students with varying levels of prior knowledge?

... provide ongoing support and resources to help students continue their financial education beyond our courses?

Prototype feedback

When speaking with our focus groups made up of college students aged 19-21, we gathered their opinions on the different features within the app, as well as the design and flow of Money Mates.

The app seems clear, easy to use and super helpful. It makes dealing with finances a lot less intimidating and I appreciate how it is simplified in terms that I can understand since I have little financial experience

Ellie Kollme, 21, Junior

I love the interactive quizzes at the end of each lesson, as they help reinforce the material; I think it's a great idea. The feedback provided after each quiz would help me understand my mistakes. To further increase engagement, the app could introduce financial challenges encouraging users to apply their knowledge in a simulated real-world setting.

George Dotsios, 19, Sophomore

The app really highlighted how important it is to learn how to manage personal finances such as taxes and managing credit in order to be a successful, independent adult.

Caroline Glenn, 19, Freshman

There’s a huge gap between the financial knowledge we have and the knowledge many jobs expect us to have. This is why the accessibility and individualized experience that comes with the app is truly something that could make a difference in setting us up for success.

Wells Hollidge, 20, Sophomore

Click to hear more from our founders!

Ecosystem

CONTRAITS

learn more

Constraints

- Limited income of target demographic may restrict the type of content and services they can afford.

- The need to provide accurate, compliant financial information within a rapidly changing financial landscape.

- Technological constraints relating to app development, maintenance, and integration with existing systems.

- Privacy and data security concerns, particularly with the use of AI and personalized learning experiences.

Users

Young Adults (17-23) who recently graduated college or high school

COMPETITORS

Competitors

- Existing financial literacy apps and platforms aimed at young adults.

- College and high school financial education programs.

- Online resources and tools provided by financial institutions.

- Influencers and celebrities who share financial advice independently.

- Traditional media that covers financial literacy topics, like books and television shows

Questions

learn more

STAKEHOLDERS

learn more

Stakeholders

- The end-users (college and high school students aged 17-23).

- Parents and guardians who might support students financially or in decision-making.

- Educational institutions that may incorporate the app into their curriculum.

- Financial experts and advisors contributing content and insights.

- Investors and sponsors funding the app development and rollout.

- Regulatory bodies overseeing financial information and education.

Questions

- How can we ensure the financial content is accurate, up-to-date, and compliant with current laws and regulations?

- What are the best practices to engage the target demographic in a way that encourages regular use and application of the knowledge?

- How will the app adapt to different learning styles and educational needs of the users?

- What metrics will be used to measure the success and impact of the app on users' financial literacy?

- How can the app remain financially viable while offering free or low-cost services to the target demographic?

Next Steps

- Conduct market research to understand the competitive landscape and identify unique value propositions.

- Engage with potential users through focus groups or surveys to validate the concept and features of the app.

- Prototype the app interface and test with a small user group to gather feedback and iterate on the design.

- Develop a content strategy that includes sourcing, verifying, and regularly updating the financial information provided in the app.

Features Comparison

Features Comparison

Cost Free

Online Acess

Personalized

AI integration

Money Mates

Media (Books, TV, ect.)

Financial Education Course

World of Money

Zogo

User Journey

Persona:

- Jamie Johnson, 19 y/o biology major

- Has some experience with budgeting, but limited knowledge of more advanced finance topics

Jamie has a new server job and needs to fill out her W-2 form, but gets confused and decides she wants to understand it.

Jamie searches the internet for resources to help her understand all of the jargon, and finds a Money Mates online advertisement.

Jamie decides to download Money Mates, realizing she wants to be completely financially literate.

Jamie creates an account and feeds the AI chatbot information about her prior knowledge, current income, and financial background.

Money Mates creates a fully custom, AI-generated curriculum for Jamie based on the information provided. She completes the course and now feels comfortable with finance topics.

introducing

Money Mates

check out our app demo!

Marketing Collateral